Weekly Newsletter Vol.5

DeFi is seeing new yieldcoins every week, what is the PMF here and is it sustainable?

by abandoning the quest for maximum yield and leverage, credit-backed protocols enable both

- Qiro Intern

Yieldcoins/Yield-Bearing Stablecoins are tokens which let a user accrue yield over their holdings by deploying the said capital into multiple different strategies from Treasury Bills to sophisticated market making.

Drawing inspiration from the Stablewatch and Redstone report, there are 3 major baskets where we can put yield coins into

1) RWA-Backed : The foundation of the yield is carried through by TradFi sources (usually Treasury Bills), these carry the least risk of the three and are heavily adopted by institutional funds with Blackrock’s BUIDL leading the line in a ~$9 billion market.

2) Onchain Native : These tokens source yield from flywheels which include lending, liquid staking derivatives, and hedging strategies on perp markets, representing the first shift from TradFi to DeFi-native exposure.

3) Managed Strategy YBS : Lying at the far end of the complexity scale, these tokens source their yield from managed strategies (imagine a person on a desk 24/7 trying to make you as much money as possible) but involving risks around curation and model risk.

Same Sector, Different Approaches

The beauty of credit lies in its diversification: from working finance loans for SMEs to institutional grade deals, crypto is ready to accelerate this with novel tokens coming up and catering to a spectrum of credit-products.

1) USDai : USDai is a very novel approach to yieldcoins, bridging onchain capital to real-world AI infrastructure.

Yield for sUSDai holders comes from the interest paid on these loans, typically targeting 13–17% APR, and is generated by the revenue from selling compute time for AI model training and inference.

2) mF-ONE

mF-ONE is a fundamentally different approach.

Instead of directly originating assets, Midas issues tokenized certificates tracking Fasanara Capital’s F-ONE strategy (diversified private credit and digital asset fund)

Fasanara’s portfolio is diversified across 140+ fintech platforms, multi-geography SME lending, and real estate creates a portfolio with millions of granular underlying exposures.

We just looked at two contrasting products operating on the same thesis of credit, but the core problem is solving structural fragility to the best of our ability.

The Yieldcoin Stack, Visualized.

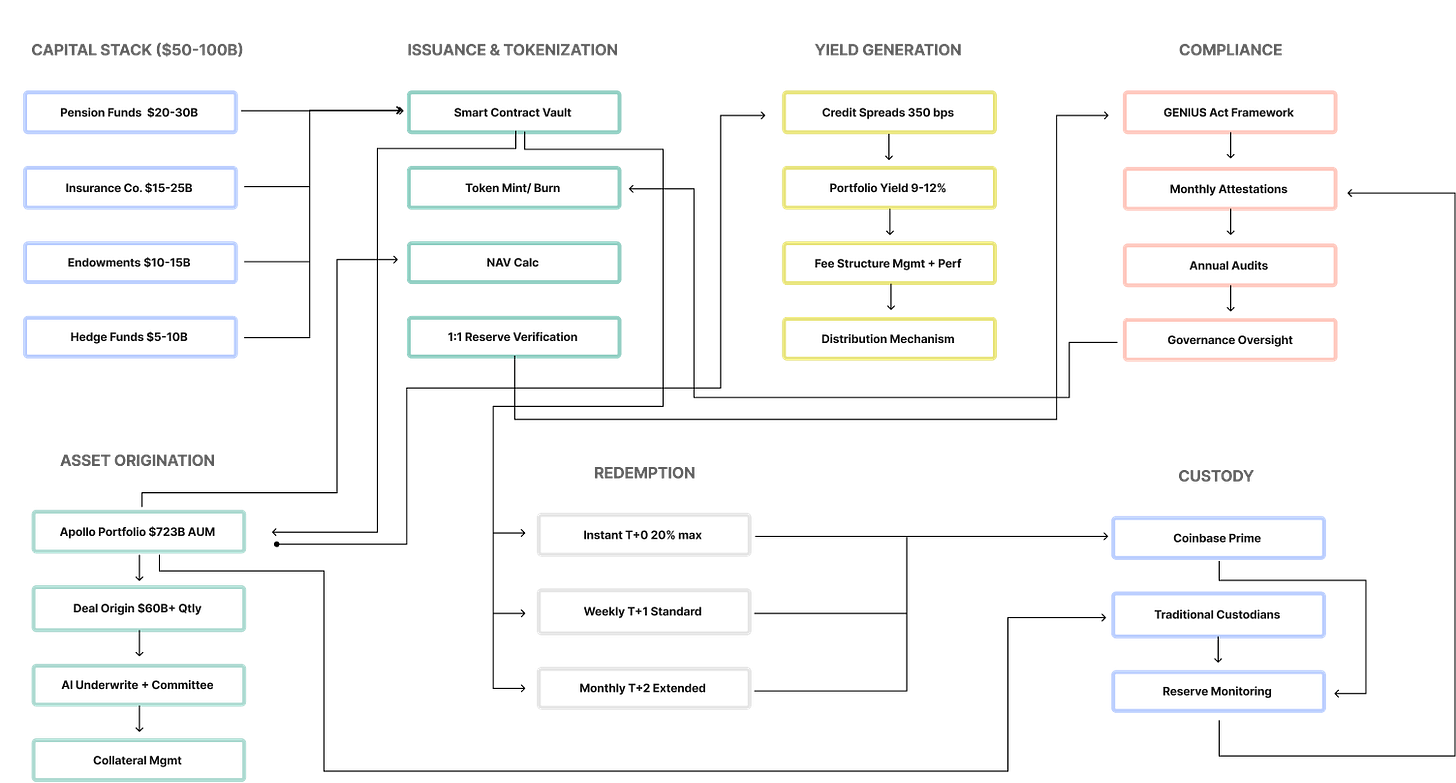

To understand how would a private credit yieldcoin function, let’s take a hypothetical example.

Apollo launching a yieldcoin, crazy right?

Upon such an event, we will see an influx form all sorts of avenues, combine this with a full-fledged issuance & tokenization, custody + redemption flow, and you get a yieldcoin with the biggest possible AUM.

We put it all below, have a look!

As good as this looks there are multiple hurdles we have to jump as a sector to enable a hyper-sustainable on-chain credit flywheel.

Infrastructure Maturity

Onchain credit is operationally viable:

Origination volume: Centrifuge Aave and other protocols have originated over $1 billion worth of real-world credit.

Settlement latency: T+0 to T+2 (vs. T+30–T+90 in traditional structures)

Custody infrastructure: Coinbase Prime, Fireblocks now handle institutional stablecoins flows at $350B+ annual volume

Regulatory Certainty: Post-GENIUS Act + MiCA De-Risk Allocations

Current framework (2025)

GENIUS Act: 100%+ reserve backing, monthly attestations, explicit redemption rules

MiCA (EU): Asset-Referenced Token classification, 40–60% reserve requirement

Institutional confidence: 90% of institutions cite regulatory clarity as adoption enabler

The current GENIUS Act framework does not allow yield to be distributed to the token holders, going forward we will be able to see regulations around yieldcoins with stringent audits, proof of reserve checks and compliance frameworks to accelerate adoption.

Looking at the sector’s growing AUM, we can project that over the next five years, capital formation will deepen as more retail and institutional investors gain exposure to on-chain yield products. A key milestone for sustainable growth would be attracting capital from wealth funds and central banks, pushing the sector’s AUM into the $50–200B+ range.

A funnel such as this with various sources of capital formation will keep the ecosystem growing at a healthy rate.

Closing, The Horizon For DeFi Credit

The path forward requires three shifts

Speculation to infrastructure: Credit-backed protocols must abandon 13-15% yield promises and signal realistic 9-11% returns anchored in actual credit spreads, not leverage fantasy. Institutions allocate capital to boring, predictable systems, not exciting experiments.

Leverage maximization to leverage management: Protocols that survive constrain leverage, isolate it, stress-test it daily, and reduce it during volatility spikes. Counter-intuitively, smaller maximum leverage enables higher sustainable returns because it prevents catastrophic failures.

Regulatory arbitrage to regulatory alignment: MiCA, GENIUS Act, and comparable frameworks aren’t threats—they’re opportunities for credibility. Protocols preemptively complying with tiered licensing, audits, and custody will inherit institutional capital fleeing unregulated alternatives.

How do we achieve maximum growth?

Just like any other sector, there exists a certain flywheel that the successors can use and refine to make it as sustainable as possible.

Once put into practice, we can visualize a 10-year North Star for the onchain credit sector, with a target AUM bracket of $100-200B.

The Final Requirement? Underwriting.

DeFi is yet to see a single composable underwriting framework, something which breaks the TradFi shackles and incorporates as many signals as possible from both onchain and offchain metrics.

If TradFi underwriting was perfect we would never see crisis or defaults like First Brands, onchain credit doesn’t just imply more speed it implies an evolution for risk assessment and covenants.

The $12B tokenized credit market expands to $100B+ when pension funds, insurers, and central banks integrate credit-backed tokens as core infrastructure.

USDai and mF-ONE are proof-of-concept that hardware-backed loans and credit fund tokenization work on blockchain.

Institutional capital at scale is capable of generating more sustainable alpha than retail speculation ever could.

Qiro saw this coming, a system where decentralized finance becomes decentralized institutional finance, this is the horizon for onchain credit, nothing more, nothing less.

We are pushing towards making onchain credit as sustainable as possible by targeting verticals like underwriting, risk covenant and capital flow monitoring.

Check us out here - qiro.fi

Until next time.

~ Team Qiro